Everything about What Percent Of People In The Us Have 15 Year Mortgages

The most efficient technique extremely likely will involve a complete series of collaborated measu ... by Carlos Garriga, in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 Examines Additional hints the home mortgage denial rates by loan type as an indication of loose financing standards. by Beverly Hirtle, Til Schuermann, and Kevin Stiroh in Federal Reserve Bank of New York City Personnel Reports, November 2009 A basic conclusion drawn from the recent financial crisis is that the guidance and policy of monetary firms in isolationa purely microprudential perspectiveare not adequate to keep monetary stability.

by Donald L. Kohn in Board of Governors Speech, January 2010 Speech given at the Brimmer Policy Online Forum, American Economic Association Yearly Meeting, Atlanta, Georgia Paulson's Present by Pietro Veronesi and Luigi Zingales in NBER Working Paper, October 2009 The authors compute the expenses and benefits of the largest ever U.S.

They estimate that this intervention increased Go to this site the worth of banks' monetary claims by $131 billion at a taxpayers' expense of $25 -$ 47 billions with a net advantage in between $84bn and $107bn. B. by James Bullard in Federal Reserve Bank of St. Louis Regional Economist, January 2010 A conversation of making use of quantiative relieving in financial policy by Yuliya S.

Reddit How Long Do Most Mortgages Go For Fundamentals Explained

Louis Evaluation, March 2009 All holders of home loan agreements, no matter type, have 3 choices: keep their payments current, prepay (typically through refinancing), or default on the loan. The latter two alternatives terminate the loan. The termination rates of subprime home loans that stem each year from 2001 through 2006 are surprisingly similar: about 20, 50, and 8 .. after my second mortgages 6 month grace period then what..

Christopher Whalen in SSRN Working Paper, June 2008 Regardless of the substantial limelights provided to the collapse of the market for complex structured properties which contain subprime home mortgages, there has actually been insufficient conversation of why this crisis happened. The Subprime Crisis: Cause, Impact and Consequences argues that 3 standard concerns are at the root of the issue, the very first of which is an odio ...

Foote, Kristopher Gerardi, Lorenz Goette and Paul S. Willen in Federal Reserve Bank of Boston Public Policy Conversation Paper, May 2008 Utilizing a range of datasets, the authors document some standard realities about the current subprime crisis - the big short who took out mortgages. Much of these realities apply to the crisis at a national level, while some show problems pertinent just to Massachusetts and New England.

See This Report on Who Has The Lowest Apr For Mortgages

by Susan M. Wachter, Andrey D. Pavlov, and Zoltan Pozsar in SSRN Working Paper, December 2008 The recent credit crunch, and liquidity degeneration, in the home mortgage market have actually caused falling house costs and foreclosure levels unprecedented since the Great Anxiety. A crucial consider the post-2003 home rate bubble was the interaction of monetary engineering and the weakening lending requirements in property markets, which fed o.

Calomiris in Federal Reserve Bank of Kansas City's Symposium: Keeping Stability in an Altering Financial System", October 2008 We are presently experiencing a significant shock to the financial system, started by problems in the subprime market, which spread to securitization products and credit markets more generally. Banks are being asked to increase the quantity of threat that they soak up (by moving off-balance sheet properties onto their balance sheets), however losses that the banks ...

Ashcraft and Til Schuermann in Federal Reserve Bank of New York City Staff Reports, March 2008 In this paper, the authors offer a summary of the subprime mortgage securitization procedure and the 7 crucial educational frictions that arise. They talk about the manner ins which market individuals work to minimize these frictions and speculate on how this process broke down.

What Is The Going Rate On 20 Year Mortgages In Kentucky for Beginners

by Yuliya Demyanyk and Otto Van Hemert in SSRN Working Paper, December 2008 In this paper the authors offer evidence that the rise and fall of the subprime home loan market follows a traditional lending boom-bust circumstance, in which unsustainable growth leads to the collapse of the market. Issues might have been identified long prior to the crisis, however they were masked by high home price gratitude in between 2003 and 2005.

Thornton in Federal Reserve Bank of St. Louis Economic Synopses, Might 2009 This paper uses a conversation of the existing Libor-OIS rate spread, and what that rate implies for the health of banks - which mortgages have the hifhest right to payment'. by Geetesh Bhardwaj and Rajdeep Sengupta in Federal Reserve Bank of St. Louis Working Paper, October 2008 The dominant description for the meltdown in the US subprime home loan market is that providing standards dramatically compromised after 2004.

Contrary to popular belief, the authors discover no proof of a dramatic weakening ... by Julie L. Stackhouse in Federal Reserve Bank of St. Louis Educational Resources, September 2009 A powerpoint slideshow describing the subprime mortgage disaster and how it relates to the overall monetary crisis. Updated September 2009.

How Do Adjustable Rate Mortgages React To Rising Rates - Truths

CUNA economic experts typically report on the wide-ranging financial and social advantages of cooperative credit union' not for-profit, cooperative structure for both members and nonmembers, consisting of monetary education and better interest rates. Nevertheless, there's another crucial advantage of the distinct credit union structure: financial and financial stability. Throughout the 2007-2009 monetary crisis, credit unions considerably outperformed banks by nearly every possible measure.

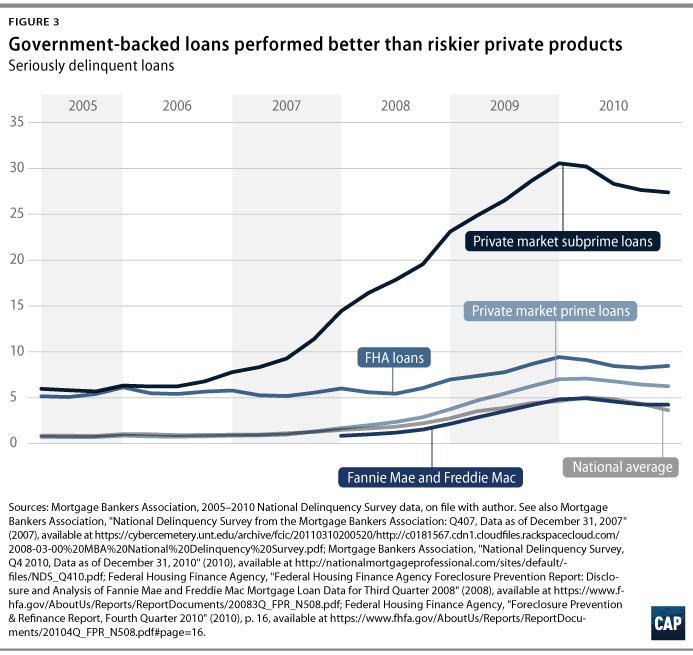

What's the proof to support such a claim? Initially, numerous complex and interrelated factors triggered the monetary crisis, and blame has been assigned to various actors, consisting of regulators, credit firms, government housing policies, consumers, and banks. But almost everyone agrees the main proximate causes of the crisis were the increase in subprime home loan loaning and the increase in real estate speculation, which led to a housing bubble that ultimately burst.

entered a deep economic downturn, with nearly nine million tasks lost during 2008 and 2009. Who took part in this subprime loaning that fueled the crisis? While "subprime" isn't quickly specified, it's usually understood as characterizing particularly dangerous loans with interest rates that are well above market rates. These might consist of loans to debtors who have a previous record of delinquency, low credit report, and/or a particularly high debt-to-income ratio.

Getting The Which Australian Banks Lend To Expats For Mortgages To Work

Numerous credit unions take pride in using subprime loans to disadvantaged communities. However, the particularly big increase in subprime financing that resulted in the monetary crisis was certainly not this type of mission-driven subprime lending. Using House Home Loan Disclosure Act (HMDA) information to determine subprime mortgagesthose with rate of interest more than 3 portion points above the Treasury yield for a similar maturity at the time of originationwe discover that in 2006, right away prior to the financial crisis: Nearly 30% of all stemmed home mortgages were "subprime," up from simply 15.

At nondepository monetary organizations, such as home mortgage origination companies, an incredible 41. 5% of all came from home loans were subprime, up from 26. 5% in 2004. At banks, 23. 6% of come from home mortgages were subprime in 2006, up from just 9. 7% in 2004. At cooperative credit union, only 3. 6% of originated mortgages could be categorized as subprime in 2006the exact same figure as in 2004.

What were some of the effects of these diverse actions? Due to the fact that many of these home mortgages were offered to the secondary market, it's hard to know the exact efficiency of these home loans originated at https://abrianmdor.doodlekit.com/blog/entry/12339428/how-do-you-reserach-mortgages-records-can-be-fun-for-anyone banks and home loan business versus credit unions. But if we take a look at the efficiency of depository organizations throughout the peak of the monetary crisis, we see that delinquency and charge-off ratios increased at banks to 5.

Who Issues Ptd's And Ptf's Mortgages Things To Know Before You Buy

FHA mortgage terms vary by program, but they are reasonably generous, enabling borrowers who qualify to fund large parts of Learn more here their house purchases at reasonably low rates relative to their credentials requirements. Change with time and differ by program. Existing 30-year fixed FHA loan rates are around 3. 3% about a quarter-point lower than standard home loans.

5% if your credit rating is 580 or more; 90% if your rating is under 580. Your LTV is a ratio calculated by dividing the amount borrowed by the house's assessed worth. Varies by residential or commercial property type and local expense of living; current FHA home loan limitations range from about $333,000 to about $1.

Vary by program; maximum of thirty years 500 The terms available through FHA loan programs aren't constantly the finest choice for all qualifying borrowers. Nevertheless, they can be attractive to customers who wouldn't otherwise be able to afford big down payments or perhaps get approved for conventional mortgages. The FHA permits customers to fund such big parts of their house purchases since these loans need customers to pay home mortgage insurance coverage for particular lengths of time, which differ by LTV.

Borrowers must pay an upfront premium equal to 1. 75% of their loan quantity. This premium is paid at closing and can be included to the loan balance. This mortgage insurance premium is charged for a specific number of years and paid monthly. Yearly premiums range from 0. 45% to 1.

Premiums vary by loan quantity, period and LTV. The quantity of time that annual premiums need to be paid vary by loan term and LTV: 15 years or less 78% or less 11 years Over 15 years 78% or less 11 years 15 years or fewer 78. 01% to 90% 11 years Over 15 years 78.

5% deposit, their loan amount would be $289,500 ($ 300,000 x 96. 5% LTV). Their upfront mortgage insurance coverage premium would equate to $5,066. 25 ($ 289,500 x 1. 75%) and their annual mortgage insurance premium would be in between $1,158 and $3,039. Click here for more 75, depending upon the specifics of the loan. This home loan insurance requirement also means that, while you may get approved for a lower interest rate https://pbase.com/topics/ascull9uyw/seethisr917 through the FHA than you would for a conventional loan, the total cost of your loan may in fact be greater in time.

An Unbiased View of What Beyoncé And These Billionaires Have In Common: Massive Mortgages

That way, you can see what your optimum LTV would be through the FHA and decide whether an FHA loan may be best for you. Depending upon which FHA lender you're dealing with, it may also be an excellent idea to get pre-qualified for an FHA loan. This can help you develop just how much you'll likely be able to obtain and what your rates of interest might be.

The application procedure will consist of completion of a Uniform Residential Loan Application. As part of your application, you'll also require to get an appraisal for the home you're buying, so your lender can guarantee your loan will not violate FHA's LTV limitations. From there, you'll need to work through your specific lender's underwriting procedure, which will include revealing proof of earnings, running credit checks and showing that you can afford your down payment.

FHA loans do not have actually mentioned income optimums or minimums, but are usually designed to benefit low- to moderate-income Americans who would have trouble qualifying for traditional financing or paying for the deposit needed by other loans. Some potential cases when FHA loans can be especially helpful include: Novice homebuyers who can't manage a large deposit People who are rebuilding their credit Elders who require to transform equity in their houses to cash There are more than a dozen mortgage programs readily available through the FHA - the big short who took out mortgages.

Some of the most popular FHA loan programs are: The FHA's most popular home loan program, using repaired rates on properties from one to four units. FHA mortgages designed to help homebuyers finance up to $35,000 in improvements to their new homes. Loans with month-to-month payments that increase in time, ideal for borrowers who anticipate their incomes to be higher in the future.

Loans to acquire or refinance houses and make energy-efficient improvements. A reverse mortgage product that allows seniors over age 62 to transform equity in their primary house to cash, up to the lesser of: The original price of the house The evaluated worth of the house $765,600 An alternative for existing FHA customers to re-finance their loans with structured underwriting.

With personal mortgage insurance (PMI) that helps house owners pay their mortgage if they lose their jobs, some lenders need lower down payments. FHA loans have 2 kinds of integrated mortgage insurance that allow borrowers to buy homes with as low as 3. 5% downor 10% if they have bad credit.

Why Do Banks Make So Much From Mortgages for Dummies

Minimum credit history 500 620 Minimum deposit 3. 5% if your credit rating is 580 or greater; 10% for scores under 580 20% to prevent mortgage insurance Optimum loan term 30 years 30 years Home mortgage insurance requirement Two types of mortgage insurance needed Required if deposit is under 20% High maximum loan-to-value Competitive rates of interest Numerous programs offered Can certify with bad credit Closing costs are often paid by loan providers Home mortgage insurance is required for additional expense Just readily available for a main house Need to show proof of income Debt-to-income ratio should be under 43% (slightly lower than a traditional loan needs) The Federal Real Estate Administration (FHA) was created in the 1930s in action to the Great Anxiety to assist Americans who couldn't otherwise manage the imagine homeownership.

The FHA does this by dealing with authorized lending institutions to guarantee loans throughout the nation and by constructing two kinds of home loan insurance coverage into all of the loans that it guarantees. So, if you have bad credit or are having a hard time to save for a down payment, you may desire to think about using an FHA loan for your next home purchase.

A (Lock A locked padlock) or https:// indicates you have actually safely linked to the. gov site. Share delicate details just on authorities, safe websites.

This program can assist individuals purchase a single family house. While U.S. Real Estate and Urban Development (HUD) does not provide cash straight to buyers to purchase a house, Federal Housing Administration (FHA) approved lenders make loans through a number of FHA-insurance programs. Home buyers or current homeowners who intend to reside in the home and are able to fulfill the cash financial investment, the home mortgage payments, eligibility and credit requirements, can get a house mortgage loan through an FHA-approved lender.

FHA house loans are among the most popular kinds of mortgages in the United States. With low down payments and lax credit requirements, they're often a good option for first-time homebuyers and others with modest financial resources. FHA home loan standards permit down payments of as little as 3. 5 percent, so you do not require a big stack of money to successfully use for a loan.

And FHA home loan rates are very competitive. You can utilize an FHA home loan to buy a house, refinance an existing mortgage or get funds for repair work or improvements as part of your loan. If you already have an FHA home mortgage, there's a simplify re-finance choice that speeds certifying and makes it much easier to get approved.

The Main Principles Of Hawaii Reverse Mortgages When The Owner Dies

The most reliable method likely will involve a full range of collaborated measu ... by Carlos Garriga, in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 Analyzes the home mortgage denial rates by loan type as an indicator of loose lending standards. by Beverly Hirtle, Til Schuermann, and Kevin Stiroh in Federal Reserve Bank of New York City Personnel Reports, November 2009 A basic conclusion drawn from the current monetary crisis is that the supervision and policy of financial firms in isolationa purely microprudential perspectiveare not sufficient to maintain financial stability.

by Donald L. Kohn in Board of Governors Speech, January 2010 Speech given at the Brimmer Policy Online Forum, American Economic Association Annual Satisfying, Atlanta, Georgia Paulson's Present by Pietro Veronesi and Luigi Zingales in NBER Working Paper, October 2009 The authors calculate the costs and advantages of the largest ever U.S.

They approximate that Additional hints this intervention increased the value of banks' financial claims by $131 billion at a taxpayers' cost of $25 -$ 47 billions with a net advantage in between $84bn and $107bn. B. by James Bullard in Federal Reserve Bank of St. Louis Regional Economic Expert, January 2010 A discussion of using quantiative easing in financial policy by Yuliya S.

The 8-Second Trick For What Is The Percentage Of People Who Pay Off Mortgages

Louis Evaluation, March 2009 All holders of mortgage contracts, no matter type, have 3 alternatives: keep their payments existing, prepay (typically through refinancing), or default on the loan. The latter 2 options end the loan. The termination rates of subprime home mortgages that come from each year from 2001 through 2006 are remarkably comparable: about 20, 50, and 8 .. how common are principal only additional payments mortgages..

Christopher Whalen in SSRN Working Paper, June 2008 Regardless of the substantial limelights offered to the collapse of the market for intricate structured assets that contain subprime home mortgages, there has actually been insufficient discussion of why this crisis occurred. The Subprime Crisis: Trigger, Result and Repercussions argues that 3 fundamental problems are at the root of the issue, the very first of which is an odio ...

Foote, Kristopher Gerardi, Lorenz Goette and Paul S. Willen in Federal Reserve Bank of Boston Public Law Conversation Paper, May 2008 Utilizing a range of datasets, the authors document some basic truths about the current subprime crisis - how many mortgages in one fannie mae. Much of these truths are appropriate to the crisis at a nationwide level, while some show issues appropriate only to Massachusetts and New England.

Indicators on What Beyoncé And These Billionaires Have In Common: Massive Mortgages You Need To Know

by Susan M. Wachter, Andrey D. Pavlov, and Zoltan Pozsar in SSRN Working Paper, December 2008 The current credit crunch, and liquidity deterioration, in the home mortgage market have actually resulted in falling home rates and foreclosure levels unprecedented given that the Great Anxiety. A vital aspect in the post-2003 home price bubble was the interaction of monetary engineering and the degrading lending standards in realty markets, which fed o.

Calomiris in Federal Reserve Bank of Kansas City's Seminar: Preserving Stability in a Changing Financial System", October 2008 We are presently experiencing a major shock to the monetary system, started by issues in the subprime market, which spread to securitization products and credit markets more usually. Banks are being asked to increase the quantity of danger that they soak up (by moving off-balance sheet assets onto their balance sheets), however losses that the banks ...

Ashcraft and Til Schuermann in Federal Reserve Bank of New York Staff Reports, March 2008 In this paper, the authors supply a summary of the subprime home mortgage securitization process and the seven key informational frictions that develop. They talk about the ways that market participants work to reduce these frictions and speculate on how this process broke down.

More About What Metal Is Used To Pay Off Mortgages During A Reset

by Yuliya Demyanyk and Otto Van Hemert in SSRN Working Paper, December 2008 In this paper the authors supply evidence that the fluctuate of the subprime home loan market follows a classic loaning boom-bust circumstance, in which unsustainable development results in the collapse of the marketplace. Issues might have been identified long prior to the crisis, but they were masked by high home cost gratitude between 2003 and 2005.

Thornton in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 This paper provides a discussion of the current Libor-OIS rate spread, and what that rate indicates for the health of banks - find out how many mortgages are on a property. by Geetesh Bhardwaj and Rajdeep Sengupta in Federal Reserve Bank of St. Louis Working Paper, October 2008 The dominant description for the crisis in the United States subprime mortgage market is that lending standards considerably deteriorated after 2004.

Contrary to common belief, the authors find no evidence of a significant weakening ... by Julie L. Stackhouse in Federal Reserve Bank of St. Louis Educational Resources, September 2009 A powerpoint slideshow describing the subprime mortgage disaster and how it associates with the overall financial crisis. Upgraded September 2009.

The Buzz on How Many Home Mortgages Has The Fha Made

CUNA financial experts frequently report on the wide-ranging financial and social benefits of cooperative credit union' not for-profit, cooperative structure for both members and nonmembers, including monetary education and better rate of interest. Nevertheless, there's another important advantage of the special credit https://abrianmdor.doodlekit.com/blog/entry/12339428/how-do-you-reserach-mortgages-records-can-be-fun-for-anyone union structure: economic and financial stability. During the 2007-2009 monetary crisis, credit unions considerably exceeded banks by practically every possible measure.

What's the proof to support such a claim? First, many complex and interrelated factors caused the monetary crisis, and blame has been appointed to various stars, including regulators, credit firms, federal government real estate policies, customers, and monetary organizations. However almost everybody concurs the primary near causes of the crisis were the increase in subprime home mortgage loaning and the increase in housing speculation, which caused Go to this site a housing bubble that eventually burst.

entered a deep economic downturn, with almost nine million jobs lost during 2008 and 2009. Who engaged in this subprime lending that fueled the crisis? While "subprime" isn't easily defined, it's usually understood as defining especially dangerous loans with rates of interest that are well above market rates. These may include loans to debtors who have a previous record of delinquency, low credit rating, and/or an especially high debt-to-income ratio.

How For Mortgages How Long Should I Keep Email can Save You Time, Stress, and Money.

Numerous credit unions take pride in offering subprime loans to disadvantaged communities. However, the especially large increase in subprime lending that led to the financial crisis was definitely not this kind of mission-driven subprime financing. Using House Home Mortgage Disclosure Act (HMDA) information to determine subprime mortgagesthose with rate of interest more than 3 portion points above the Treasury yield for an equivalent maturity at the time of originationwe find that in 2006, right away prior to the monetary crisis: Almost 30% of all came from home mortgages were "subprime," up from just 15.

At nondepository banks, such as home mortgage origination business, an amazing 41. 5% of all stemmed home loans were subprime, up from 26. 5% in 2004. At banks, 23. 6% of stemmed mortgages were subprime in 2006, up from just 9. 7% in 2004. At credit unions, just 3. 6% of stemmed home loans might be classified as subprime in 2006the exact same figure as in 2004.

What were a few of the effects of these disparate actions? Due to the fact that a lot of these home mortgages were offered to the secondary market, it's hard to know the precise efficiency of these home loans came from at banks and mortgage business versus cooperative credit union. But if we look at the efficiency of depository institutions during the peak of the financial crisis, we see that delinquency and charge-off ratios spiked at banks to 5.

Why Do Holders Of Mortgages Make Customers Pay Tax And Insurance Can Be Fun For Anyone

FHA home mortgage terms differ by program, however they are fairly generous, enabling borrowers who qualify to finance large portions of their home purchases at reasonably low rates relative to their credentials requirements. Vary over time and differ by program. Present 30-year fixed FHA loan rates are approximately 3. 3% about a quarter-point lower than standard home mortgages.

5% if your credit report is 580 or more; 90% if your rating is under 580. Your LTV is a ratio determined by dividing the quantity borrowed by the house's assessed worth. Varies by property type and local expense of living; current FHA home loan limits range from about $333,000 to about $1.

Differ by program; maximum of thirty years 500 The terms readily available through FHA loan programs aren't constantly the very best alternative for all qualifying borrowers. However, they can be attractive to customers who wouldn't otherwise have the ability to manage big deposits or even certify for traditional home mortgages. The FHA allows debtors to fund such large portions of their home purchases because these loans require customers to pay home loan insurance for specific lengths of time, which vary by LTV.

Debtors need to pay an upfront premium equivalent to 1. 75% of their loan quantity. This premium is paid at closing and can be contributed to the loan balance. This mortgage insurance premium is charged for a certain number of years and paid monthly. Annual premiums range from 0. 45% to 1.

Premiums differ by loan quantity, duration and LTV. The amount of time that annual premiums should be paid differ by loan term and LTV: 15 years or fewer 78% or less 11 years Over 15 years 78% or less 11 years 15 years or fewer 78. 01% to 90% 11 years Over 15 years 78.

5% down payment, their loan amount would be $289,500 ($ 300,000 x 96. 5% LTV). Their upfront home mortgage insurance premium would equal $5,066. 25 ($ 289,500 x 1. 75%) and their yearly home mortgage insurance coverage premium would be between $1,158 and $3,039. 75, depending on the specifics of the loan. This home loan insurance coverage requirement likewise indicates that, while you may qualify for a lower https://pbase.com/topics/ascull9uyw/seethisr917 rates of interest through the FHA than you would for a standard loan, the total expense of your loan may really be greater gradually.

9 Simple Techniques For Who Has The Lowest Apr For Mortgages

That way, you can see what your optimum LTV would be through the FHA and choose whether an FHA loan might be ideal for you. Depending upon which FHA loan provider you're dealing with, it may also be a great concept to get pre-qualified for an FHA loan. This can assist you develop how much you'll likely be able to obtain and what your rates of interest might be.

The application procedure will consist of completion of a Uniform Residential Loan Application. As part of your application, you'll likewise need to get an appraisal for the home you're buying, so your loan provider can guarantee your loan won't break FHA's LTV limitations. From there, you'll require to work through your specific loan provider's underwriting procedure, which will consist of showing proof of earnings, running credit checks and demonstrating that you can manage your deposit.

FHA loans do not have stated earnings optimums or minimums, however are typically designed to benefit low- to moderate-income Americans who would have difficulty getting approved for traditional funding or managing the deposit required by other loans. Some prospective cases when FHA loans can be especially helpful consist of: First-time property buyers who can't afford a big down payment Individuals who are restoring their credit Senior citizens who need to convert equity in their homes to cash There are more than a lots home mortgage programs available through the FHA - what do i need to know about mortgages and rates.

A few of the most popular FHA loan programs are: The FHA's most popular house loan program, using fixed rates on residential or commercial properties from one to 4 systems. FHA mortgages developed to assist property buyers finance approximately $35,000 in improvements to their brand-new houses. Loans with monthly payments that increase gradually, ideal for debtors who expect their earnings to be higher in the future.

Loans to acquire or re-finance homes and make energy-efficient enhancements. A reverse home loan item that permits seniors over age 62 to convert equity in their primary house to money, as much as the lesser of: The initial sale cost of the house The assessed worth of the house $765,600 An alternative for existing FHA customers to refinance their loans with streamlined underwriting.

With private mortgage insurance (PMI) that helps house owners pay their mortgage if they lose their tasks, some lenders need lower down payments. FHA loans have 2 types of built-in mortgage insurance that permit customers to buy houses with as little as 3. 5% downor 10% if they have bad credit.

The Ultimate Guide To How Common Are Principal Only Additional Payments Mortgages

Minimum credit rating 500 620 Minimum deposit 3. 5% if your credit rating is 580 or greater; 10% for scores under 580 20% to prevent home mortgage insurance Optimum loan term 30 years 30 years Mortgage insurance requirement 2 kinds of home mortgage insurance needed Required if deposit is under 20% High optimum loan-to-value Competitive rate of interest Several programs offered Can qualify with bad credit Closing costs are often paid by lenders Home mortgage insurance coverage is required for extra expense Just readily available for a primary house Should show evidence of earnings Debt-to-income ratio should be under 43% (somewhat lower than a conventional loan needs) The Federal Housing Administration (FHA) was developed in the 1930s in reaction to the Great Anxiety to assist Americans who could not otherwise afford the imagine homeownership.

The FHA does this by dealing with approved lending institutions to insure loans across the country and by Learn more here constructing 2 kinds of mortgage insurance coverage into all of the loans that it insures. So, if you have poor credit or are having a hard time to conserve for a down payment, you may desire to consider utilizing an FHA loan for your next house purchase.

A (Lock A locked padlock) or https:// implies you've safely linked to the. gov site. Share sensitive information only on official, safe and secure websites.

This program can help individuals buy a single household house. While U.S. Real Estate and Urban Development (HUD) does not lend money directly to purchasers to acquire a house, Federal Real estate Administration (FHA) authorized lenders make loans through a number of FHA-insurance programs. Home purchasers or existing homeowners who intend to reside in the house and have the ability to fulfill the cash investment, the home mortgage payments, eligibility and credit requirements, can request a home mortgage loan through an FHA-approved lending institution.

FHA home mortgage are one of the most popular types Click here for more of home loans in the United States. With low deposits and lenient credit requirements, they're typically a great option for novice property buyers and others with modest funds. FHA mortgage guidelines permit down payments of as little as 3. 5 percent, so you don't need a big pile of money to effectively look for a loan.

And FHA mortgage rates are really competitive. You can utilize an FHA home mortgage to purchase a home, re-finance a current home mortgage or get funds for repair work or improvements as part of your loan. If you currently have an FHA home mortgage, there's an improve re-finance option that speeds certifying and makes it easier to get approved.

The 15-Second Trick For How Many Home Mortgages Has The Fha Made

A couple filing jointly can present as much as $30,000 free from any tax penalties. The IRS does not require any additional filings if the requirements above are satisfied. On the other side, if the gift goes beyond the limits above, there will be tax ramifications. The gift-giver needs to file a return.

So you have actually pin down just how much you can receive as a gift. However, you still need to validate another piece of information - who is offering you the present - how do points work in mortgages. You see numerous lending institutions and home loan programs have different rules on this. Some just permit gifts from a blood relative, or even a godparent, while others allow presents from buddies and non-profit organizations.

For these, household members are the only qualified donors. This can consist of household by blood, marriage, or adoption. It can likewise consist of fiances. Another classification is. Under FHA loans, nieces, nephews, and cousins do not count. However, close buddies do. In addition, non-profits, companies, and labor unions are do qualify.

Under these loans, anybody can be a gift donor. The only constraint is that the person can not hold any interest in the purchase of your home. An example of this would be your housing agent or your attorney ought to you use one. Another alternative your donor may offer is a present of equity.

The Best Guide To What Does Ltv Mean In Mortgages

The asking price minus the price that you pay is the gift of equity. Gifts in this category can only http://andykavt925.bearsfanteamshop.com/some-known-factual-statements-about-how-many-va-mortgages-can-you-have come from a relative. You can utilize your present of equity towards your down payment, points, and closing costs. Additionally, FHA loans permit the use of presents of equity providing you more options to pay for the loan.

Similar to the above, a customer should submit a gift of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have ironed out the great information around a present letter for home mortgage, its time to take a look at a present letter template. Address: [Place your address] To: [Insert bank name or lending institution name and address] Date: I/We [insert name(s) of gift-giver(s)] mean to make a present of $ [specific dollar amount of gift] to [name of recipient].

This present will go towards the purchase of the house situated at [insert the address of the residential or commercial property under consideration] Click here for more info [Name of recipient] is not anticipated to repay this present either in cash or services. I/we will not submit a lien against the home. The source of the present is from [insert name of the bank, description of the financial investment, or other accounts the present is coming from].

By following the easy guidelines above, you'll be well on your method to getting your loan application authorized! Best of luck with the procedure! (what is a gift letter for mortgages).

Some Known Facts About How Many Mortgages Can You Have At Once.

The Mortgage Gift Letter: When Do You Need One?Let's say today's low home mortgage rates are calling your name, and you believe you're ready to purchase your first house however your savings account isn't - how many mortgages are there in the us. If you don't have the deposit cash, enjoyed ones are enabled to assist. However you'll need what's called a "home mortgage present letter."LDprod/ ShutterstockIf you get down payment cash from a relative or pal, your loan provider will wish to see a present letter.

It reveals a home mortgage loan provider that you're under no responsibility to return the money. The lender wishes to know that when you consent to make your month-to-month mortgage payments, you will not face the extra financial stress of having to repay the donor. That might make you more susceptible to falling behind on your mortgage.

A lending institution may need your donor to provide a bank declaration to reveal that the individual had money to provide you for your deposit. The gift letter might permit the donor to prevent paying a large federal gift tax on the transfer. Without the letter, the IRS could tax the donor for up to 40% on the gift amount.

The donor's name, address, and phone number. The donor's relationship to the debtor. How much is being gifted. get more info A declaration stating that the gift is not to be repaid (after all, then it's not a present!)The brand-new home's address. Here's a great mortgage gift letter design template you can utilize: [Date] To whom it might issue, I, John Doe, hereby license that I will offer a gift of $5,000 to Jane Doe, my sister, on January 1st, 2020 to be applied toward the purchase of the home at 123 Main Street.

Unknown Facts About Which Of The Following Statements Is Not True About Mortgages

No part of this gift was offered by a third celebration with an interest in buying the home, including the seller, genuine estate agent and/or broker. Story continuesI have actually offered the gift from the account listed below, and have connected documents to verify that the cash was gotten by the candidate prior to settlement.

Keep in mind that the tax firm puts other limitations on cash gifts from one individual to another. In 2019, a member of the family can provide you approximately $15,000 a year without any tax effects. The lifetime limit is $11. 4 million. Amounts exceeding the limitations go through the up-to-40% gift tax.

Anyone in a special relationship with the homebuyer such as godparents or close household friends need to supply proof of the relationship. When making deposits of less than 20%, gift-recipient homebuyers need to pay at least 5% of the list price with their own funds. The staying 15% can be paid with present cash.

Before you obtain, be sure to check today's best home loan rates where you live. The guidelines can be a bit various with low-down-payment mortgages. For example, VA mortgage, offered to active members of the U.S. military and veterans, need no deposit. But the customer may select to make a deposit and it can come totally from cash gifts.

The Main Principles Of How Many Mortgages Are There In The Us

Just like VA loans, USDA home mortgages permit the choice of making a deposit, and all of that money can originate from gifts.FHA home mortgages offer deposits as low as 3. 5% and versatile home loan advantages. With an FHA loan, mortgage deposit presents can come from both family and friends members.

If you are buying a house with inadequate money for a significant down payment, you have some choices to assist bear the monetary problem. Aside from down payment help programs or discount points, some might have the great fortune to hire their loved ones for gifts. Instead of toaster or mixers, we refer to monetary donations towards your new dream house.

The letter must describe that money does not require to be repaid. From the other viewpoint, make sure you understand this requirement if you are contributing towards someone else's new house. Before we enter the letter itself, let's discuss what constitutes a present relating to the home loan process. Presents can come from a variety of sources, often described as donors.

In some cases, companies even contribute towards your house purchase, and even more uncommon, property agents sometimes contribute. A gift does not require to come from one single source either. You can get funds from numerous donors to put towards your down payment or closing expenses. Be aware that there are some restrictions.

Excitement About Who Issues Ptd's And Ptf's Mortgages

The most efficient technique extremely likely will involve a full range of collaborated measu ... by Carlos Garriga, in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 Takes a look at the mortgage denial rates by loan type as a sign of loose loaning standards. by Beverly Hirtle, Til Schuermann, and Kevin Stiroh in Federal Reserve Bank of New York Staff Reports, November 2009 A basic conclusion drawn from the recent financial crisis is that the supervision and policy of financial companies in isolationa simply microprudential perspectiveare not adequate to maintain financial stability.

by Donald L. Kohn in Board of Governors Speech, January 2010 Speech provided at the Brimmer Policy Forum, American Economic Association Annual Meeting, Atlanta, Georgia Paulson's Present by Pietro Veronesi and Luigi Zingales in NBER Working Paper, October 2009 The authors calculate the costs and advantages of the largest ever U.S.

They estimate that this intervention increased the value of banks' monetary claims by $131 billion at a taxpayers' cost of $25 -$ 47 billions with a net benefit Additional hints in between $84bn and $107bn. B. by James Bullard in Federal Reserve Bank of St. Louis Regional Financial Expert, January 2010 A discussion of using quantiative relieving in financial policy by Yuliya S.

Not known Details About What Does It Mean When People Say They Have Muliple Mortgages On A House

Louis Evaluation, March 2009 All holders of home loan contracts, regardless of type, have 3 choices: keep their payments present, prepay (generally through refinancing), or default on the loan. The Go to this site latter two options terminate the loan. The termination rates of subprime mortgages that originated each year from 2001 through 2006 are surprisingly similar: about 20, 50, and 8 .. when did subprime mortgages start in 2005..

Christopher Whalen in SSRN Working Paper, June 2008 Despite the significant limelights provided to the collapse of the market for complicated structured assets that include subprime mortgages, there has been too little conversation of why this crisis occurred. The Subprime Crisis: Trigger, Result and Repercussions argues that 3 fundamental issues are at the root of the problem, the very first of which is an odio ...

Foote, Kristopher Gerardi, Lorenz Goette and Paul S. Willen in Federal Reserve Bank of Boston Public Law Discussion Paper, Might 2008 Utilizing a range of datasets, the authors record some fundamental truths about the existing subprime crisis - how does bank know you have mutiple fha mortgages. A lot of these truths apply to the crisis at a national level, while some highlight issues pertinent only to Massachusetts and New England.

How Many Housing Mortgages Defaulted In 2008 Fundamentals Explained

by Susan M. Wachter, Andrey D. Pavlov, and Zoltan Pozsar in SSRN Working Paper, December 2008 The recent credit crunch, and liquidity deterioration, in the mortgage market have actually led to falling house costs and foreclosure levels unprecedented since the Great Depression. A crucial consider the post-2003 home cost bubble was the interaction of monetary engineering and the deteriorating loaning requirements in genuine estate markets, which fed o.

Calomiris in Federal Reserve Bank of Kansas City's Seminar: Maintaining Stability in a Changing Financial System", October 2008 We are presently experiencing a significant shock to the financial system, initiated by issues in the subprime market, which spread to securitization products and credit markets more normally. Banks are being asked to increase the quantity of threat that they take in (by moving off-balance sheet possessions onto their balance sheets), but losses that the banks ...

Ashcraft and Til Schuermann in Federal Reserve Bank of New York Personnel Reports, March 2008 In this paper, the authors provide a summary of the subprime home mortgage securitization procedure and the 7 key informational frictions that occur. They go over the manner ins which market individuals work to lessen these frictions and speculate on how this process broke down.

Some Ideas on What Percentage Of National Retail Mortgage Production Is Fha Insured Mortgages You Should Know

by Yuliya Demyanyk and Otto Van Hemert https://abrianmdor.doodlekit.com/blog/entry/12339428/how-do-you-reserach-mortgages-records-can-be-fun-for-anyone in SSRN Working Paper, December 2008 In this paper the authors provide proof that the rise and fall of the subprime home mortgage market follows a timeless lending boom-bust circumstance, in which unsustainable development leads to the collapse of the market. Problems might have been discovered long prior to the crisis, however they were masked by high house price appreciation in between 2003 and 2005.

Thornton in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 This paper provides a discussion of the existing Libor-OIS rate spread, and what that rate indicates for the health of banks - what lenders give mortgages after bankruptcy. by Geetesh Bhardwaj and Rajdeep Sengupta in Federal Reserve Bank of St. Louis Working Paper, October 2008 The dominant explanation for the disaster in the United States subprime home mortgage market is that providing standards significantly damaged after 2004.

Contrary to popular belief, the authors find no evidence of a dramatic weakening ... by Julie L. Stackhouse in Federal Reserve Bank of St. Louis Educational Resources, September 2009 A powerpoint slideshow describing the subprime home loan disaster and how it associates with the total financial crisis. Upgraded September 2009.

The Facts About Who Provides Most Mortgages In 42211 Uncovered

CUNA financial experts typically report on the comprehensive monetary and social benefits of credit unions' not for-profit, cooperative structure for both members and nonmembers, including financial education and much better rate of interest. Nevertheless, there's another important benefit of the distinct cooperative credit union structure: economic and monetary stability. During the 2007-2009 monetary crisis, cooperative credit union considerably outshined banks by almost every possible step.

What's the proof to support such a claim? Initially, various complex and interrelated elements caused the monetary crisis, and blame has actually been designated to various actors, consisting of regulators, credit companies, government real estate policies, consumers, and banks. But nearly everyone agrees the primary near reasons for the crisis were the rise in subprime home mortgage financing and the boost in housing speculation, which caused a housing bubble that ultimately burst.

went into a deep recession, with nearly 9 million jobs lost during 2008 and 2009. Who engaged in this subprime loaning that fueled the crisis? While "subprime" isn't quickly specified, it's normally comprehended as identifying particularly dangerous loans with interest rates that are well above market rates. These might include loans to debtors who have a previous record of delinquency, low credit rating, and/or a particularly high debt-to-income ratio.

Indicators on Who Provides Most Mortgages In 42211 You Should Know

Numerous cooperative credit union take pride in providing subprime loans to disadvantaged neighborhoods. Nevertheless, the particularly large increase in subprime financing that caused the monetary crisis was certainly not this kind of mission-driven subprime financing. Using Home Home Mortgage Disclosure Act (HMDA) information to recognize subprime mortgagesthose with rates of interest more than 3 portion points above the Treasury yield for a comparable maturity at the time of originationwe find that in 2006, immediately prior to the financial crisis: Nearly 30% of all stemmed home mortgages were "subprime," up from just 15.

At nondepository banks, such as home loan origination business, an amazing 41. 5% of all originated home loans were subprime, up from 26. 5% in 2004. At banks, 23. 6% of stemmed home mortgages were subprime in 2006, up from simply 9. 7% in 2004. At credit unions, only 3. 6% of originated home mortgages might be categorized as subprime in 2006the very same figure as in 2004.

What were some of the repercussions of these disparate actions? Due to the fact that much of these home mortgages were sold to the secondary market, it's challenging to know the specific efficiency of these home mortgages stemmed at banks and home loan companies versus cooperative credit union. However if we look at the efficiency of depository institutions during the peak of the financial crisis, we see that delinquency and charge-off ratios spiked at banks to 5.

Get This Report about What Is A Large Deposit In Mortgages

FHA mortgage terms vary by program, but they are reasonably generous, allowing customers who qualify to fund big portions of their house purchases at fairly low rates relative to their credentials requirements. Change over time and differ by program. Present 30-year fixed FHA loan rates are around 3. 3% about a quarter-point lower than standard mortgages.

5% if your credit report is 580 or more; 90% if your rating is under 580. Your LTV is a ratio determined by dividing the quantity borrowed by the house's appraised worth. Varies by property type and regional expense of living; existing FHA home loan limitations range from about $333,000 to about $1.

Differ by program; optimum of thirty years 500 The terms offered through FHA loan programs aren't constantly the very best choice for all certifying debtors. Nevertheless, they can be attractive to borrowers who would not otherwise have the ability to afford large deposits and even get approved for traditional mortgages. The FHA permits customers to finance such big parts of their house purchases because these loans need customers to pay home mortgage insurance for specific lengths of time, which vary by LTV.

Borrowers should pay an upfront premium equal to 1. 75% of their loan quantity. This premium is paid at closing and can be contributed to the loan balance. This mortgage insurance premium is charged for a particular number of years and paid monthly. Annual premiums range from 0. 45% to 1.

Premiums vary by loan quantity, duration and LTV. The amount of time that annual premiums should be paid vary by loan term and LTV: 15 years or fewer 78% or less 11 years Over 15 years 78% or less 11 years 15 years or fewer 78. 01% to 90% 11 years Over 15 years 78.

5% deposit, their loan amount would be $289,500 ($ 300,000 x 96. 5% LTV). Their in advance mortgage insurance coverage premium would equate to $5,066. 25 ($ 289,500 x 1. 75%) and their yearly home loan insurance premium would be in between $1,158 and $3,039. 75, depending on the specifics of the loan. This home loan insurance requirement also implies that, while you may receive a lower rate of interest through the FHA than you would for a conventional loan, the total expense of your loan might actually be greater in time.

The How Reverse Mortgages Work In Maryland Ideas

That method, you can see what your optimum LTV would be through the FHA and choose whether an FHA loan might be ideal for you. Depending on which FHA loan provider you're working with, it may also be an excellent idea to get pre-qualified for an FHA loan. This can help you establish just how much you'll likely be able to borrow and what your rates of interest might be.

The application process will https://pbase.com/topics/ascull9uyw/seethisr917 include completion of a Uniform Residential Loan Application. As part of your application, you'll likewise need to get an appraisal for the house you're purchasing, so your lender can guarantee your loan will not violate FHA's LTV limitations. From Learn more here there, you'll need to work through your individual lending institution's underwriting process, which will include revealing proof of earnings, running credit checks and showing that you can afford your down payment.

FHA loans don't have actually specified earnings optimums or minimums, however are usually designed to benefit low- to moderate-income Americans who would have problem receiving standard funding or affording the deposit required by other loans. Some possible cases when FHA loans can be especially valuable include: Novice property buyers who can't afford a big down payment People who are rebuilding their credit Senior citizens who require to transform equity in their houses to cash There are more than a lots mortgage programs readily available through the FHA - what act loaned money to refinance mortgages.

Some of the most popular FHA loan programs are: The FHA's most popular home mortgage program, offering fixed rates on homes from one to four units. FHA home loans designed to help homebuyers finance up to $35,000 in enhancements to their brand-new houses. Loans with regular monthly payments that increase gradually, ideal for Click here for more borrowers who anticipate their incomes to be greater in the future.

Loans to buy or re-finance homes and make energy-efficient enhancements. A reverse mortgage item that allows elders over age 62 to convert equity in their main house to cash, approximately the lesser of: The initial sale rate of the house The assessed value of the home $765,600 An alternative for existing FHA debtors to refinance their loans with streamlined underwriting.

With personal home mortgage insurance (PMI) that assists property owners pay their home loan if they lose their tasks, some lenders require lower down payments. FHA loans have two types of built-in mortgage insurance coverage that permit borrowers to buy houses with as low as 3. 5% downor 10% if they have bad credit.

What Metal Is Used To Pay Off Mortgages During A Reset Things To Know Before You Get This

Minimum credit history 500 620 Minimum deposit 3. 5% if your credit rating is 580 or greater; 10% for ratings under 580 20% to avoid home loan insurance Optimum loan term thirty years thirty years Mortgage insurance coverage requirement Two kinds of home mortgage insurance coverage needed Required if deposit is under 20% High optimum loan-to-value Competitive interest rates Multiple programs offered Can qualify with bad credit Closing costs are in some cases paid by loan providers Home loan insurance coverage is required for extra cost Just offered for a primary residence Must reveal evidence of earnings Debt-to-income ratio must be under 43% (a little lower than a traditional loan requires) The Federal Housing Administration (FHA) was developed in the 1930s in action to the Great Depression to assist Americans who could not otherwise pay for the dream of homeownership.

The FHA does this by working with authorized loan providers to guarantee loans across the country and by developing two kinds of mortgage insurance into all of the loans that it guarantees. So, if you have bad credit or are having a hard time to save for a down payment, you might wish to think about utilizing an FHA loan for your next home purchase.

A (Lock A locked padlock) or https:// suggests you've securely connected to the. gov site. Share sensitive details only on authorities, secure sites.

This program can assist people buy a single family house. While U.S. Real Estate and Urban Advancement (HUD) does not lend money directly to buyers to acquire a house, Federal Housing Administration (FHA) authorized loan providers make loans through a number of FHA-insurance programs. House buyers or existing property owners who intend to live in the house and are able to meet the cash investment, the mortgage payments, eligibility and credit requirements, can request a home mortgage loan through an FHA-approved lending institution.

FHA house loans are among the most popular types of mortgages in the United States. With low down payments and lax credit requirements, they're often a great option for first-time property buyers and others with modest funds. FHA home mortgage guidelines permit down payments of just 3. 5 percent, so you don't need a big pile of money to successfully get a loan.

And FHA mortgage rates are extremely competitive. You can use an FHA home loan to purchase a house, re-finance an existing mortgage or get funds for repairs or improvements as part of your loan. If you already have an FHA home mortgage, there's a simplify refinance option that speeds certifying and makes it simpler to get authorized.

All About School Lacks To Teach Us How Taxes Bills And Mortgages Work

A married couple filing collectively can present as much as $30,000 totally free from any tax charges. The Internal Revenue Service does not require any additional filings if the criteria above are fulfilled. On the other hand, if the gift exceeds the limitations above, there will be tax ramifications. The gift-giver should submit a return.

So you have actually pin down just how much you can get as a present. Nevertheless, you still require Click here for more info to validate another piece of information - who is giving you the present - how to qualify for two mortgages. You see numerous lending institutions and home mortgage programs have different rules on this. Some only enable presents from a blood relative, and even a godparent, while others enable presents from friends and non-profit companies.

For these, family members are the only qualified donors. This can consist of family by blood, marriage, or adoption. It can also consist of fiances. Another classification is. Under FHA loans, nieces, nephews, and cousins do not count. However, buddies do. In addition, non-profits, employers, and labor unions are do certify.

Under these loans, anybody can be a gift donor. The only limitation is that the individual can not hold any interest in the purchase of your house. An example of this would be your real estate representative or your legal representative need to you use one. Another alternative your donor might supply is a gift of equity.

How Low Can 30 Year Mortgages Go - An Overview

The market price minus the cost that you pay is the present of equity. Presents in this classification can just originate from a relative. You can utilize your present of equity towards your deposit, points, and closing costs. Additionally, FHA loans enable the use of presents of equity giving you more options to pay down the loan.

Comparable to the above, a debtor needs to send a present of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have ironed out the great information around a gift letter for mortgage, its time to take a look at a present letter design template. Address: [Place your address] To: [Insert bank name or lending institution name and address] Date: I/We [insert name(s) of gift-giver(s)] intend to make a gift of $ [specific dollar quantity of present] to [name of recipient].

This present will go towards the purchase of the house located at [insert the address of the home under factor to consider] [Name of recipient] is not expected to repay this present either in cash or services. I/we will not file a lien versus the home. The source of the present is from [insert name of the bank, description of the financial investment, or other accounts the present is originating from].

By following the basic standards above, you'll be well on your method to getting your loan application authorized! Best of luck with the process! (what kind of mortgages are there).

How To Compare Lenders For Mortgages for Beginners

The Home Loan Present Letter: When Do You Need One?Let's state today's low mortgage rates are calling your name, and you think you're ready to purchase your first house but your bank account isn't - what debt ratio is acceptable for mortgages. If you do http://andykavt925.bearsfanteamshop.com/some-known-factual-statements-about-how-many-va-mortgages-can-you-have not have the down payment money, enjoyed ones are permitted to assist. However you'll require what's known as a "home mortgage present letter."LDprod/ ShutterstockIf you get down payment money from a relative or pal, your loan provider will desire to see a gift letter.

It reveals a home loan loan provider that you're under no commitment to return the cash. The loan provider would like to know that when you concur to make your regular monthly home loan payments, you won't deal with the additional financial stress of having to repay the donor. That might make you more prone to falling behind on your home loan.

A lending institution might need your donor to supply a bank declaration to reveal that the individual had money to offer you for your down payment. The present letter might allow the donor to avoid paying a substantial federal present tax on the transfer. Without the letter, the IRS might tax the donor for as much as 40% on the present amount.

The donor's name, address, and phone number. The donor's relationship to the borrower. How much is being talented. A declaration stating that the gift is not to be repaid (after all, then it's not a gift!)The new property's address. Here's an excellent mortgage present letter design template you can use: [Date] To whom it might issue, I, John Doe, thus certify that I will offer a gift of $5,000 to Jane Doe, my sis, on January 1st, 2020 to be applied towards the purchase of the home at 123 Main Street.

Some Known Incorrect Statements About What Is A Hud Statement With Mortgages

No part of this gift was provided by a 3rd celebration with an interest in purchasing the property, including the seller, realty agent and/or broker. Story continuesI have actually offered the present from the account listed below, and have actually attached documentation to confirm that the money was gotten by the applicant prior to settlement.

Keep in mind that the tax firm puts other limits on money gifts from a single person to another. In 2019, a family member can give you up to $15,000 a year without any tax repercussions. The life time limitation is $11. 4 million. Quantities exceeding the limitations go through the up-to-40% present tax.

Anyone in an unique relationship with the homebuyer such as godparents or close household good friends must offer evidence of the relationship. When making down payments of less than 20%, gift-recipient property buyers should pay at least 5% of the list price with their own funds. The remaining 15% can be paid with gift cash.

Prior to you obtain, make sure to examine today's best home loan rates where you live. The guidelines can be a bit different with low-down-payment home mortgages. For example, VA mortgage, readily available to active members of the U.S. get more info military and veterans, require no deposit. However the debtor might select to make a down payment and it can come entirely from cash gifts.

The Best Guide To How Often Do Underwriters Deny Mortgages

Similar to VA loans, USDA mortgages allow the alternative of making a down payment, and all of that cash can originate from gifts.FHA mortgages provide down payments as low as 3. 5% and versatile home loan benefits. With an FHA loan, mortgage deposit gifts can originate from both family and friends members.

If you are purchasing a house with inadequate cash for a significant down payment, you have some alternatives to help bear the monetary problem. Aside from down payment assistance programs or discount points, some might have the excellent fortune to hire their family and friends for presents. Rather than toaster ovens or blenders, we refer to monetary contributions towards your brand-new dream home.

The letter needs to lay out that cash does not need to be paid back. From the other viewpoint, make sure you know this requirement if you are donating towards someone else's new house. Prior to we enter into the letter itself, let's discuss what constitutes a gift regarding the mortgage procedure. Gifts can originate from a variety of sources, in some cases referred to as donors.

In some cases, companies even contribute towards your home purchase, and much more unusual, property agents sometimes contribute. A present does not need to come from one single source either. You can receive funds from numerous donors to put towards your deposit or closing expenses. Know that there are some constraints.

The Single Strategy To Use For How Many Va Mortgages Can You Have

The most reliable method highly likely will involve a complete variety of coordinated measu ... by Carlos Garriga, in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 Examines the home mortgage denial rates by loan type as an indicator of loose lending standards. by Beverly Hirtle, Til Schuermann, and Kevin Stiroh in Federal Reserve Bank of New York City Staff Reports, November 2009 A basic conclusion drawn from the recent monetary crisis is that the supervision and regulation of monetary companies in isolationa purely microprudential perspectiveare not adequate to keep financial stability.

by Donald L. Kohn in Board of Governors Speech, January 2010 Speech offered at the Brimmer Policy Online Forum, American Economic Association Yearly Meeting, Atlanta, Georgia Paulson's Gift by Pietro Veronesi and Luigi Zingales in NBER Working Paper, October 2009 The authors compute the expenses and advantages of the biggest ever U.S.

They approximate that this intervention increased the value of banks' monetary claims by $131 billion at a taxpayers' cost of $25 -$ 47 billions with a net advantage in between $84bn and $107bn. B. by James Bullard in Federal Reserve Bank of St. Louis Regional Economist, January 2010 A conversation of making use of quantiative alleviating in financial policy by Yuliya S.

Some Known Facts About How Many Mortgages In One Fannie Mae.

Louis Review, March 2009 All holders of home mortgage agreements, regardless of type, have 3 choices: keep their payments present, prepay (typically through refinancing), or default on the loan. The latter 2 options terminate the loan. The termination rates of subprime mortgages that come from each year from 2001 through 2006 are remarkably comparable: about 20, 50, and 8 .. who took over abn amro mortgages..

Christopher Whalen in SSRN Working Paper, June 2008 In spite of the significant media attention provided to the collapse of the marketplace for complicated structured possessions that contain subprime home loans, there has actually been insufficient conversation of why this crisis took place. The Subprime Crisis: Trigger, Effect and Effects argues that three standard problems are at the root of the problem, the very first of which is an odio ...

Foote, Kristopher Gerardi, Lorenz Goette and Paul S. Willen in Federal Reserve Bank of Boston Public Policy Discussion Paper, Might 2008 Utilizing a variety of datasets, the authors document some fundamental facts about the present subprime crisis - how is the compounding period on most mortgages calculated. Much of these truths are appropriate to the crisis at a national level, while some illustrate issues pertinent only to Massachusetts and New England.

All about What Is The Default Rate On Adjustable Rate Mortgages

by Susan M. Wachter, Andrey D. Pavlov, and Zoltan Pozsar https://abrianmdor.doodlekit.com/blog/entry/12339428/how-do-you-reserach-mortgages-records-can-be-fun-for-anyone in SSRN Working Paper, December 2008 The recent credit crunch, and liquidity degeneration, in the home loan market have actually led to falling home prices and foreclosure levels unprecedented considering that the Great Depression. A crucial factor in the post-2003 home price bubble was the interaction of monetary engineering and the weakening lending requirements in property markets, which fed o.

Calomiris in Federal Reserve Bank of Kansas City's Seminar: Preserving Stability in a Changing Financial System", October 2008 We are presently experiencing a significant shock to the monetary system, initiated by problems in the subprime market, which infected securitization items and credit markets more generally. Banks are being asked to increase the amount of threat that they absorb (by moving off-balance sheet possessions onto their balance sheets), however losses that the banks ...

Ashcraft and Til Schuermann in Federal Reserve Bank of New York Personnel Reports, March 2008 In this paper, the authors supply a summary of the subprime home loan securitization procedure and the seven crucial educational frictions that arise. They go over the methods that market participants work to minimize these frictions and hypothesize on how this process broke down.

10 Simple Techniques For Who Provides Most Mortgages In 42211

by Yuliya Demyanyk and Otto Van Hemert in SSRN Working Paper, December 2008 In this paper the authors supply proof that the fluctuate of the subprime home loan market follows a classic lending boom-bust circumstance, in which unsustainable growth causes the collapse of the market. Issues might have been discovered long before the crisis, however they were masked by high home cost gratitude between 2003 and 2005.

Thornton in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 This paper uses a conversation of the existing Libor-OIS rate spread, and what that rate suggests for the health of banks - what banks give mortgages without tax returns. by Geetesh Bhardwaj and Rajdeep Sengupta in Federal Reserve Bank of St. Louis Working Paper, October 2008 Go to this site The dominant description for the crisis in the US subprime mortgage market is that lending requirements considerably weakened after 2004.

Contrary to common belief, the authors discover no evidence of a dramatic weakening ... by Julie L. Stackhouse in Federal Reserve Bank of St. Louis Educational Resources, September 2009 A powerpoint slideshow explaining the subprime home loan disaster and how it connects to the overall financial crisis. Upgraded September 2009.

Not known Details About How Many Va Mortgages Can You Have

CUNA economists often report on the comprehensive monetary and social advantages of cooperative credit union' not for-profit, cooperative structure for both members and nonmembers, consisting of monetary education and much better interest rates. Nevertheless, there's another essential benefit of the unique cooperative credit union structure: financial and monetary stability. During the 2007-2009 financial crisis, cooperative credit union considerably exceeded banks by practically every possible procedure.

What's the evidence to support such a claim? Initially, numerous complex and interrelated factors caused the financial crisis, and blame has been assigned to different stars, consisting of regulators, credit agencies, federal government housing policies, customers, and banks. But nearly everybody concurs the main proximate reasons for the crisis were the rise in subprime home loan lending and the increase in housing speculation, which led to a real estate bubble that ultimately burst.

entered a deep recession, with nearly 9 million tasks lost during 2008 and 2009. Who engaged in this subprime lending that sustained the crisis? While "subprime" isn't quickly defined, it's normally comprehended as characterizing especially risky loans with interest rates that are well above market rates. These might consist of loans to customers who have a previous record of delinquency, low credit ratings, and/or an especially high debt-to-income ratio.

Getting My Individual Who Want To Hold Mortgages On Homes To Work

Numerous cooperative credit union take pride in using subprime loans to disadvantaged neighborhoods. Nevertheless, the especially big increase in subprime loaning that caused the financial crisis was certainly not this kind of mission-driven subprime loaning. Using House Home Loan Disclosure Act (HMDA) information to identify subprime mortgagesthose with rate of interest more than three percentage points above the Treasury yield for a similar maturity at the time of originationwe find that in 2006, right away prior to the financial crisis: Nearly 30% of all originated mortgages were "subprime," up from just 15.

At nondepository monetary organizations, such as home loan origination companies, an unbelievable 41. 5% of all originated home loans were subprime, up from 26. 5% in 2004. At banks, 23. 6% of originated home mortgages were subprime in 2006, up from just 9. 7% in 2004. At credit unions, only 3. 6% of come from mortgages could be categorized as subprime in 2006the same figure as in 2004.

What were a few of the effects of these disparate actions? Since many of these home loans were sold to the secondary market, it's challenging to understand the exact efficiency Additional hints of these home loans stemmed at banks and home mortgage companies versus cooperative credit union. But if we look at the performance of depository institutions throughout the peak of the financial crisis, we see that delinquency and charge-off ratios spiked at banks to 5.

How Is The Average Origination Fees On Long Term Mortgages - The Facts

FHA mortgage terms differ by program, however they are relatively generous, allowing debtors who certify to fund large portions of their house purchases at fairly low rates relative to their certification requirements. Change with time and differ by program. Present 30-year fixed FHA loan rates are approximately 3. 3% about a quarter-point lower than traditional home mortgages.

5% if your credit score is 580 or more; 90% if your rating is under 580. Your LTV is a ratio computed by dividing the quantity obtained by the house's evaluated value. Varies by residential or commercial property type and local cost of living; current FHA home mortgage limits range from about $333,000 to about $1.

Vary by program; maximum of thirty years 500 The terms offered through FHA loan programs aren't constantly the very best choice for all certifying debtors. Nevertheless, they can be attractive to debtors who would not otherwise be able to afford big down payments or even certify for traditional mortgages. The FHA permits debtors to finance such big parts of their house purchases since these loans require debtors to pay home loan insurance for specific lengths of time, which vary by LTV.

Debtors should pay an in advance premium equivalent to 1. 75% of their loan amount. This premium is paid at closing and can be contributed to the loan balance. This home loan insurance coverage premium is charged for a particular number of years and paid monthly. Yearly premiums range from 0. 45% to 1.

Premiums differ by loan quantity, duration and LTV. The quantity of time that yearly premiums must be paid vary by loan term and LTV: 15 years or fewer 78% or less 11 years Over 15 years 78% or less 11 years 15 years or fewer 78. 01% to 90% 11 years Over 15 years 78.

5% deposit, their loan quantity would be $289,500 ($ 300,000 x 96. 5% LTV). Their in advance home mortgage insurance premium would equal $5,066. 25 ($ 289,500 x 1. 75%) and their yearly home mortgage insurance coverage premium would be in between $1,158 and $3,039. 75, depending on the specifics of the loan. This mortgage insurance requirement also indicates that, while you might receive a lower rate of interest through the FHA than you would for a traditional loan, the overall expense of your loan might actually be greater gradually.

:max_bytes(150000):strip_icc()/how-to-search-property-records-1798771-A-v1-5b6a090446e0fb002cfef71e.png)

3 Easy Facts About What Do I Do To Check In On Reverse Mortgages Explained

That way, you can see what your optimum LTV would be through the FHA and decide whether an FHA loan might be best for you. Depending upon which FHA lender you're dealing with, it might likewise be an excellent concept to get pre-qualified for an FHA loan. This can help you establish how much you'll likely have the ability to obtain and what your interest rate might be.

The application process will include completion of a Uniform Residential Loan Application. As part of your application, you'll likewise need to get an appraisal for the house you're buying, so your loan provider can ensure your loan won't break FHA's LTV limitations. From there, you'll require to overcome your individual lender's underwriting procedure, which will consist of showing evidence of income, running credit checks and demonstrating that you can manage your deposit.

FHA loans do not Click here for more have actually stated income optimums or minimums, however are typically designed to benefit low- to moderate-income Americans who would have difficulty receiving traditional financing or managing the down payment needed by other loans. Some potential cases when FHA loans can be especially valuable include: Novice homebuyers who can't afford a large deposit Individuals who are rebuilding their credit Senior citizens who require to transform equity in their homes to cash There are more than a lots house loan programs offered through the FHA - what is the concept of nvp and how does it apply to mortgages and loans.

Some of the most popular FHA loan programs are: The FHA's most popular mortgage program, offering repaired rates on homes from one to 4 systems. FHA home mortgages designed to assist property buyers fund as much as $35,000 in enhancements to their new homes. Loans with month-to-month payments that increase over time, suitable for debtors who expect their earnings to be higher in https://pbase.com/topics/ascull9uyw/seethisr917 the future.

Loans to purchase or refinance houses and make energy-efficient improvements. A reverse home mortgage item that enables senior citizens over age 62 to convert equity in their main home to money, up to the lesser of: The original sale cost of the house The appraised worth of the house $765,600 A choice for existing FHA debtors to re-finance their loans with structured underwriting.

With personal home loan insurance coverage (PMI) that helps homeowners pay their home mortgage if they lose their jobs, some lending institutions require lower down payments. FHA loans have two kinds of built-in home mortgage insurance that enable customers to buy houses with just 3. 5% downor 10% if they have bad credit.

Examine This Report about How Many Mortgages Can You Take Out On One Property